Time to Consider a Trade for PAYX?

Oct. 31st, 2024

Time to Consider a Trade for PAYX?

While I was looking through my ‘buy list’ this yesterday morning to see if any stocks were offering an attractive trade setup, I came across this one trade and I didn’t need to see any others.

You may have seen this trade setup earlier yesterday too, but if not, don’t worry, I am going to tell you exactly which stock is currently trading in the ‘Buy Zone’.

The stock that caught my eye was Paychex, Inc., symbol: (PAYX).

Once I saw the stock chart for Paychex, Inc., I noticed that the stock had traded into prime trade entry territory, which I call my ‘Buy Zone’.

Below is a snapshot of PAYX’s current stock chart. Let’s do some analysis of the chart so you can see what made me stop what I was doing and begin looking for a potential trade to place.

Looking at this chart for PAYX, you can see the stock is in the midst of a strong bullish uptrend which we want to target. But this alone is not enough to convince me that I need to jump in on a trade right then.

Another crucial component of placing successful trades over time is knowing the correct time to enter the trade. This is why I always look at the Keltner Channels before I fire off a trade.

Keltner Channels can serve as an overbought or oversold indicator for stocks. If a stock’s daily stock price is trading above the upper Keltner Channel, this signals that the stock is temporarily overbought and subject to a retracement.

Even stocks that are in the strongest bull trends do not advance in a straight line. There are always price retracements along the way. When a stock becomes overbought, more likely than not, the stock will soon experience a slight pullback.

When we identify stocks in powerful uptrends, these are the stocks we want to trade and we use the Keltner Channels to help pick our entry point. When a bullish stock dips into our ‘Buy Zone’, this is when we want to put on a trade.

The Keltner Channel “Buy Zone” occurs when a stock is trading below the upper Keltner Channel. Once the daily price is trading below the upper channel, it provides a lower-risk buying opportunity as the bullish stock is likely to continue rallying.

How I Would Look to Trade It

Now that we have identified the stock that we want to trade and we have pinpointed our entry point, the next question is how do we actually want to gain exposure to this trade?

Of course, you could simply buy the stock shares, which we sometimes do, but, many times when we spot a setup like this we want to add a bit more leverage to our position to unlock more explosive profit potentials.

With a setup like this, we like to find a call option to purchase which would provide us with a little more leverage on our trade. By doing this, should the bullish trend continue, our trade is positioned to produce higher profits when compared to just owning the underlying stock shares.

When selecting which call option to purchase, I often rely on my 1% Rule to help narrow down my choice of option strikes. The 1% Rule helps me select an in-the-money option that has a higher probability of producing a profit when compared to an at-the-money or out-of-the money option. Once I have one selected I will vet the trade using my Call Option Purchase calculator to determine the trade’s profit potential.

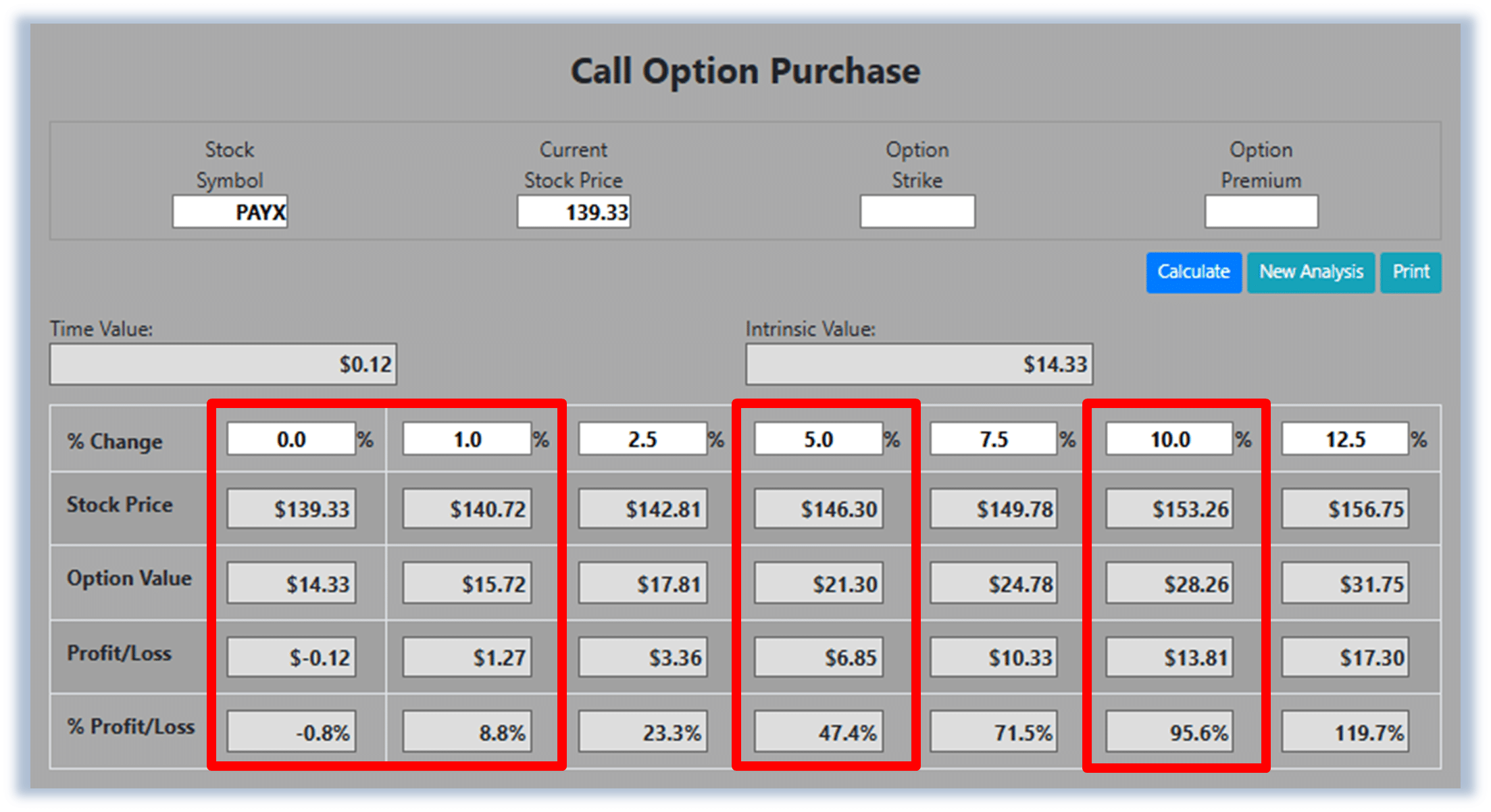

Below is a snapshot of my Call Option Purchase Calculator that shows the profit potential analysis for my trade. This example examines a range of PAYX shares remaining flat up to a 12.5% increase at option expiration.

95.6% Profit Potential for PAYX Option

The trade analysis shows that if PAYX shares were to increase by just 1% at option expiration, this trade would make 8.8%.

Then looking at a few of the bigger potential moves, if PAYX shares were up 5.0% at option expiration, our option would be set to profit 47.4%!

If that doesn’t sound good enough, get this, if PAYX shares were up 10.0% at option expiration, this call option would be set to produce a 95.6% profit! That means the call option would outperform the stock nearly 10 to 1!

By following my 1% Rule to select which call options to purchase, this has helped me in the past to juice my trade’s profit potential, just like in the example shown above. Additionally, the 1% Rule helps to increase the odds that the option will profit as the underlying stock only has to increase by 1% for the option to begin profiting.

The Hughes Optioneering Team is here to help you identify high-probability trades just like this one.

*Trading incurs risk and some people lose money trading.