CB: Insurance Giant Marching Higher

June 11th, 2024

CB: Insurance Giant Marching Higher

June 10th, we looked at a Daily Price Chart for Public Service Enterprise Group Inc., noting that PEG stock was trading in the Keltner Channel ‘Buy Zone’.

For June 11th Trade of the Day e-letter we will be looking at a daily price chart for Chubb Ltd. (CB). Chubb is the world’s largest publicly traded property and casualty insurance company. Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance to a diverse group of clients.

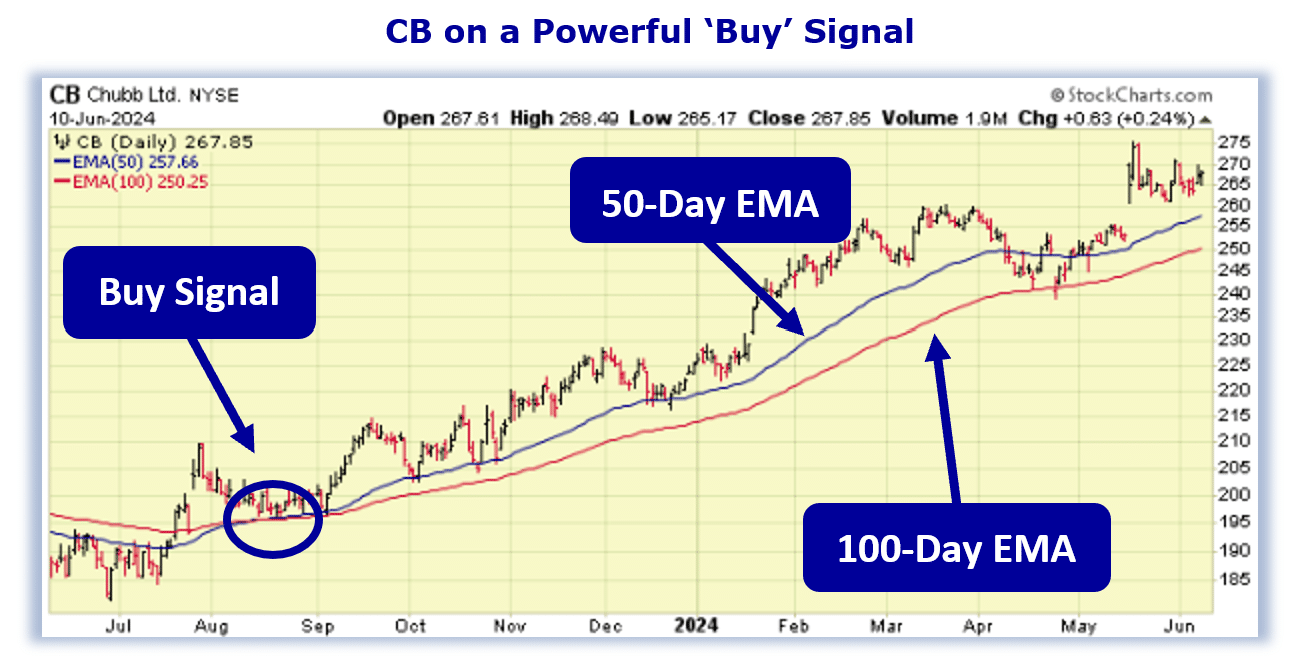

Below is a Daily Price chart with the 50-Day EMA and 100-Day EMA for CB.

Buy CB Stock

As the chart shows, on August 15th, the CB 50-Day EMA, crossed above the 100-Day EMA.

This crossover indicated the buying pressure for CB stock exceeded the selling pressure. For this kind of crossover to occur, a stock has to be in a strong bullish trend.

Now, as you can see, the 50-Day EMA is still above the 100-Day EMA meaning the ‘buy’ signal is still in play.

As long as the 50-Day EMA remains above the 100-Day EMA, the stock is more likely to keep trading at new highs and should be purchased.

Profit if CB is Up, Down, or Flat

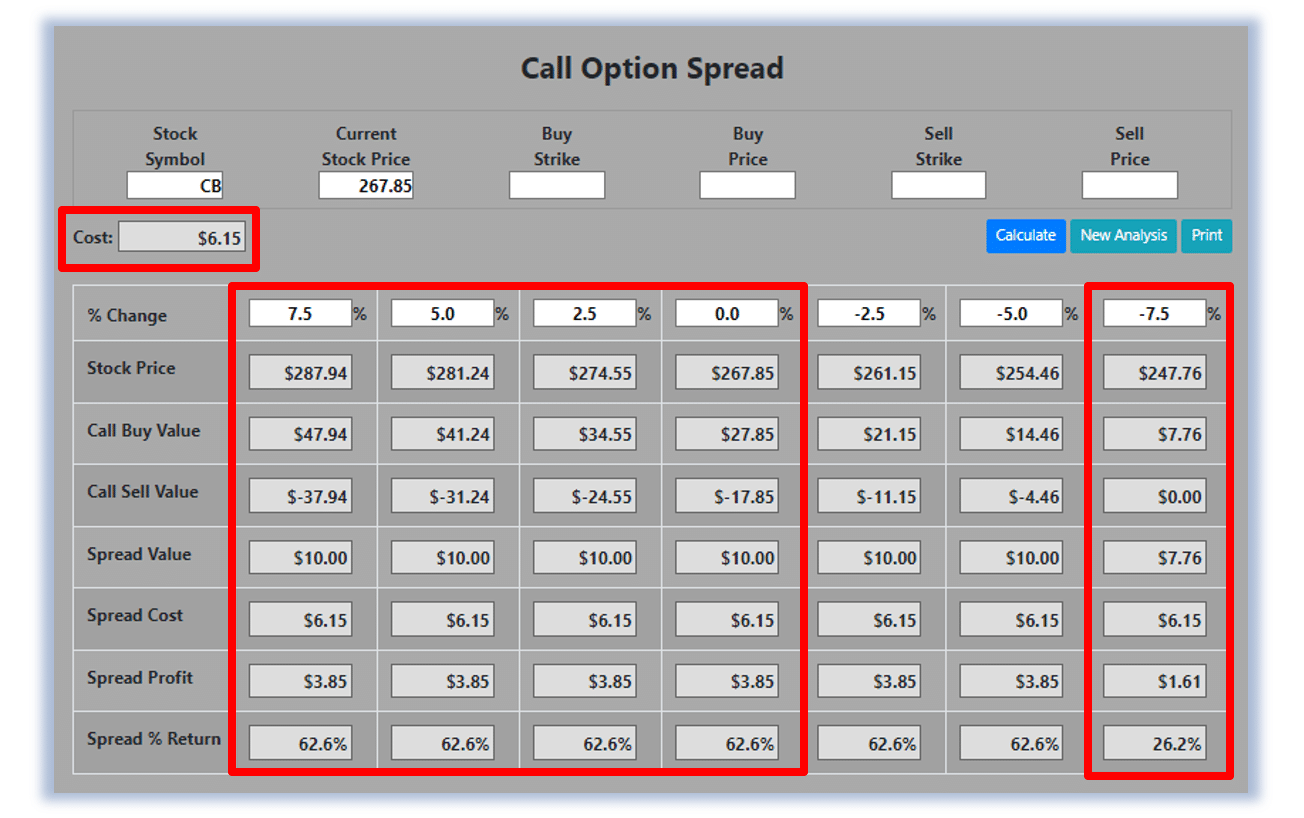

Now, since CB’s 50-Day EMA is trading above the 100-Day EMA and will likely rally from here, let’s use the Hughes Optioneering calculator to look at the potential returns for a CB call option spread.

The analysis reveals that if CB stock is flat or up at all at expiration the spread will realize a 62.6% return (circled).

And if CB stock decreases 7.5% at option expiration, the option spread would make a 26.2% return (circled).

Due to option pricing characteristics, this option spread has a ‘built in’ 62.6% profit potential when the trade was identified*.

The prices and returns represented below were calculated based on the current stock and option pricing for CB on 6/10/2024 before commissions.

Option spread trades can result in a higher percentage of winning trades compared to a directional option trade if you can profit when the underlying stock/ETF is up, down or flat.

A higher percentage of winning trades can give you the discipline needed to become a successful trader.

The Hughes Optioneering Team is here to help you identify profit opportunities just like this one.

Sneak Peek: Chuck’s Copilot!

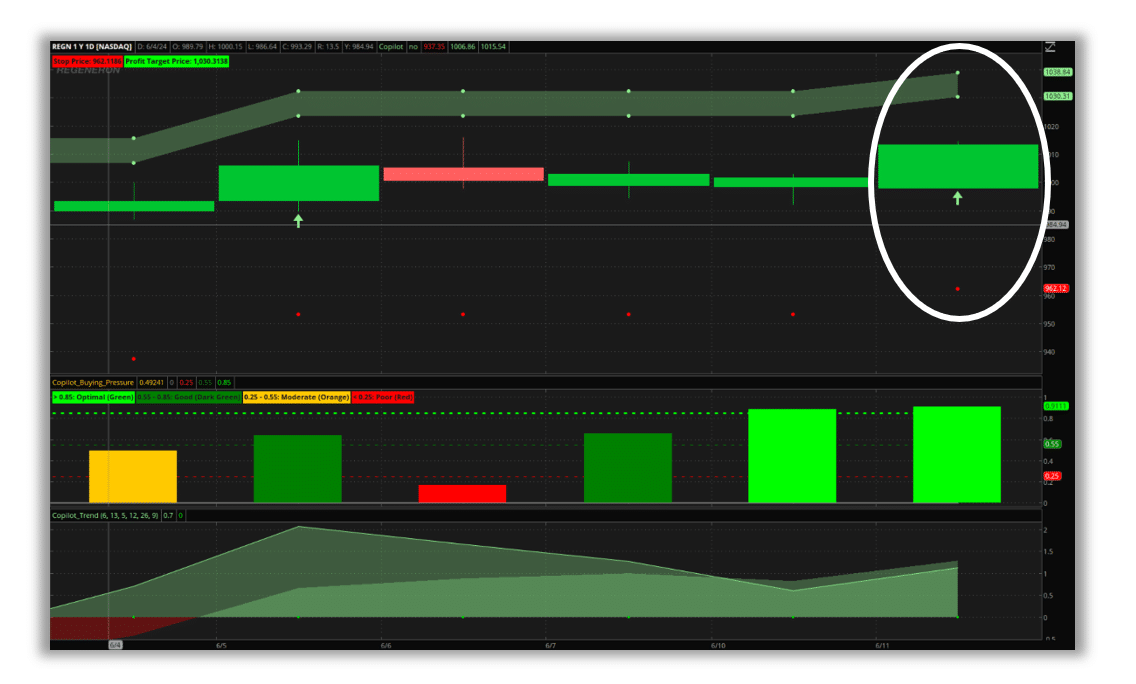

I want to give you a sneak peek at something that I’ve been working on. I call it my Copilot and it helps me identify prime trade opportunities.

Take a look at the buy signal that Copilot found for me today.

Copilot identified that REGN is breaking out to the upside and offers a strong trade setup.

Stay tuned for more to come about Copilot!

Chuck Hughes