GDX: More Room Left To Run?

Oct. 24th, 2024

GDX: More Room Left To Run?

While I was watching the markets and yesterday’s trading action, when I came across this one ETF in particular, what I saw piqued my interest.

The trade that came over the wire yesterday was for the VanEck Vectors Gold Miners ETF symbol: (GDX).

It’s what I saw in GDX’s stock chart that made this potential trade stand above the rest when I saw it today.

Take a look below at a current snapshot of GDX’s stock chart and I’ll break down for you what I see when I see this chart.

When looking at this stock chart for the VanEck Vectors Gold Miners ETF, the first thing that stands out to me is the powerful technical ‘Buy’ signal that is currently flashing!

In this daily price chart, you can see there are also two Exponential Moving Averages (EMA) overlaid. The shorter term line is the 50-Day EMA and the longer term line is the 100-Day EMA.

The chart shows that in late March, as GDX shares were beginning to gain steam and trade higher, the ETF’s 50-Day EMA crossed above the 100-Day EMA. This created a brand new technical ‘Buy’ signal for GDX shares.

When I come across a technical signal like this, I consider it a ‘Buy’ because the shorter term EMA is beginning to outpace the longer term EMA which is indicative of a sustained move higher.

In order for an EMA crossover like this to occur, strong buying pressure has to be generated for a stock, driving the shares higher. An EMA trading system like the 50/100-Day EMA system, is able to identify these sustained momentum thrusts when the crossover occurs offering traders an opportunity to jump in and participate in the move.

Now, even though the original crossover occurred a few months back, this does not mean it is too late to capitalize on the ETF’s bullish trend. When ETFs break out to the upside like this, the bullish trend can often last longer than one might think.

Since the 50-Day EMA is still trading above the 100-Day EMA, this means the ‘Buy’ signal is still intact and this trend is still tradable. Since this bullish trend is still in play, let’s discuss how I would look to place a trade on the GDX ETF.

How I Would Look to Trade It

Now that we have identified the ETF on a powerful ‘Buy’ signal that we want to trade, the next question is how do we actually want to gain exposure to this trade?

Of course you could simply buy the ETF shares, which we sometimes do, but, many times when we spot a setup like this we want to add a bit more leverage to our position to unlock more explosive profit potentials.

With a setup like this, we like to find a call option to purchase which would provide us with a little more leverage on our trade. By doing this, should the bullish trend continue, our trade is positioned to produce higher profits when compared to just owning the underlying ETF shares.

When selecting which call option to purchase, I often rely on my 1% Rule to help narrow down my choice of option strikes. The 1% Rule helps me select an in-the-money option that has a higher probability of producing a profit when compared to an at-the-money or out-of-the money option. Once I have one selected I will vet the trade using my Call Option Purchase calculator to determine the trade’s profit potential.

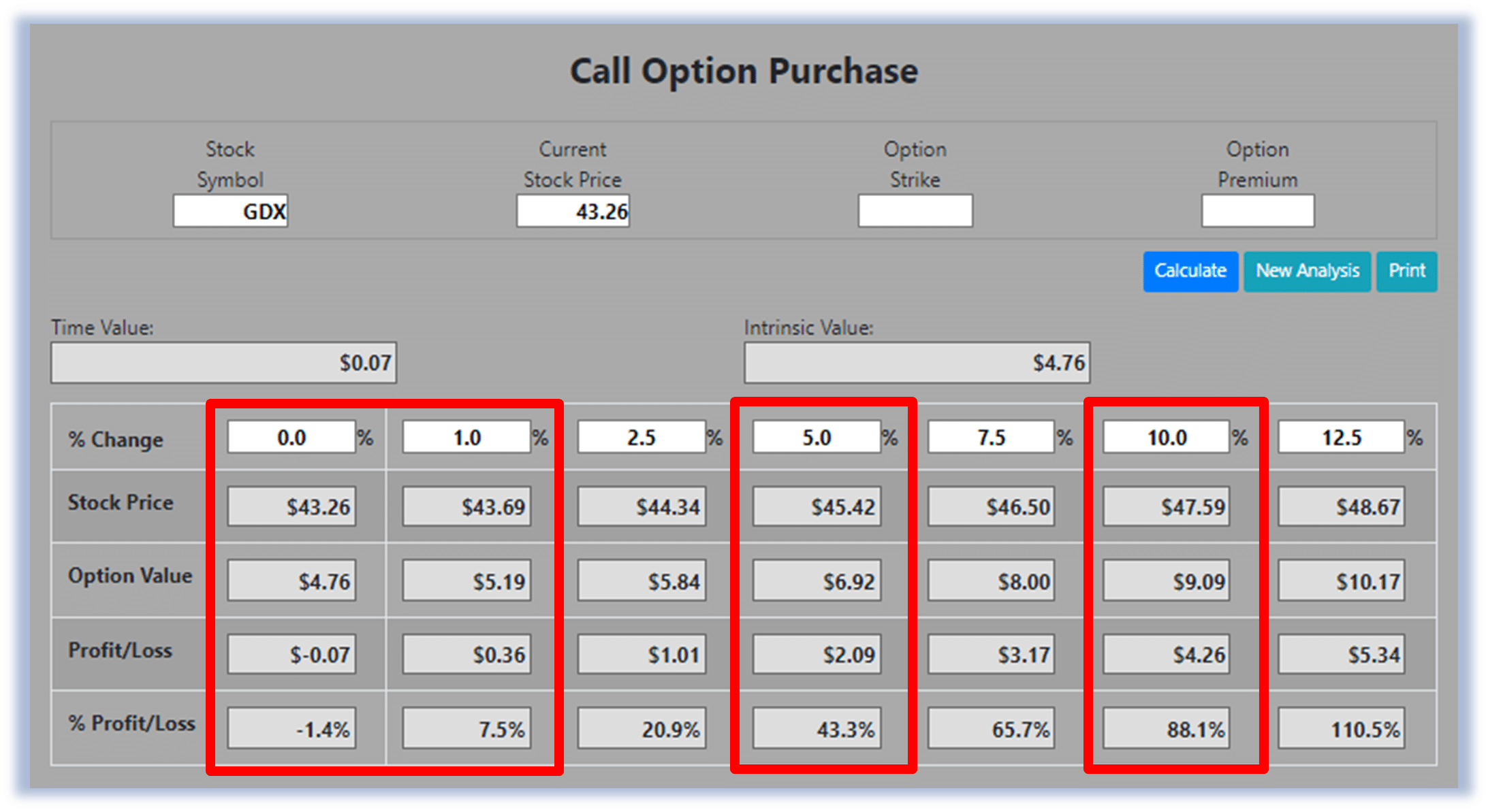

Below is a snapshot of my Call Option Purchase Calculator that shows the profit potential analysis for my trade. This example examines a range of GDX shares remaining flat up to a 12.5% increase at option expiration.

88.1% Profit Potential for GDX Option

The trade analysis shows that if GDX shares were to increase by just 1% at option expiration, this trade would make 7.5%.

Then looking at a few of the bigger potential moves, if GDX shares were up 5.0% at option expiration, our option would be set to profit 43.3%!

If that doesn’t sound good enough, get this, if GDX shares were up 10.0% at option expiration, this call option would be set to produce an 88.1% profit! That means the call option would outperform the ETF nearly 9 to 1!

By following my 1% Rule to select which call options to purchase, this has helped me in the past to juice my trade’s profit potential, just like in the example shown above. Additionally, the 1% Rule helps to increase the odds that the option will profit as the underlying ETF only has to increase by 1% for the option to begin profiting.

The Hughes Optioneering Team is here to help you identify high-probability trades just like this one.

Interested in accessing the Optioneering Calculators? Join one of Chuck’s Trading Services for unlimited access! The Optioneering Team has option calculators for six different option strategies that allow you to calculate the profit potential for an option trade before you take the trade.

*Trading incurs risk and some people lose money trading.