BK STOCK SURGES ON BUYING INFLOWS

Posted by Chuck Hughes | Jan 9, 2024 | Chuck’s Trade of the Day |

On Jan 8th, we looked at a Daily Price Chart of Amgen, Inc., noting that AMGN stock is currently making a series of new 52-Week Highs.

For today’s Trade of the Day we will be looking at an On Balance Volume chart for Bank of New York Mellon Corp. stock symbol: BK.

Before breaking down BK’s OBV chart let’s first review which products and services are offered by the company.

The Bank of New York Mellon Corporation is a financial services company that has been in business since 1784. The company’s global client base consists of financial institutions, corporations, government agencies, endowments and foundations as well as high-net-worth individuals. BNY Mellon can act as a single point of contact for clients looking to create, trade, hold, manage, service, distribute or restructure investments.

Confirming a Price Uptrend with OBV

The BK daily price chart below shows that BK is in a price uptrend as the current price is above the price BK traded at six months ago (circled). The On Balance Volume chart is below the daily chart.

On Balance Volume measures volume flow with a single Easy-to-Read Line. Volume flow precedes price movement and helps sustain the price uptrend. When a stock closes up, volume is added to the line. When a stock closes down, volume is subtracted from the line. A cumulative total of these additions and subtractions form the OBV line.

On Balance Volume Indicator

● When Close is Up, Volume is Added

● When Close is Down, Volume is Subtracted

● A Cumulative Total of Additions and Subtractions form the OBV Line

Volume flow precedes price and is the key to measuring the validity and sustainability of a price trend.

We can see from the OBV chart below that the On Balance Volume line for BK is sloping up. An up-sloping line indicates that the volume is heavier on up days and buying pressure is exceeding selling pressure. Buying pressure must continue to exceed selling pressure in order to sustain a price uptrend. So, On Balance Volume is a simple indicator to use that confirms the price uptrend and its sustainability.

The numerical value of the On Balance Volume line is not important. We simply want to see an up-sloping line to confirm a price uptrend.

Confirmed ‘Buy’ Signal for BK

Since BK’s OBV line is sloping up, the most likely future price movement for BK is up, making BK a good candidate for a stock purchase or a call option purchase.

Let’s use the Hughes Optioneering calculator to look at the potential returns for a BK call option purchase.

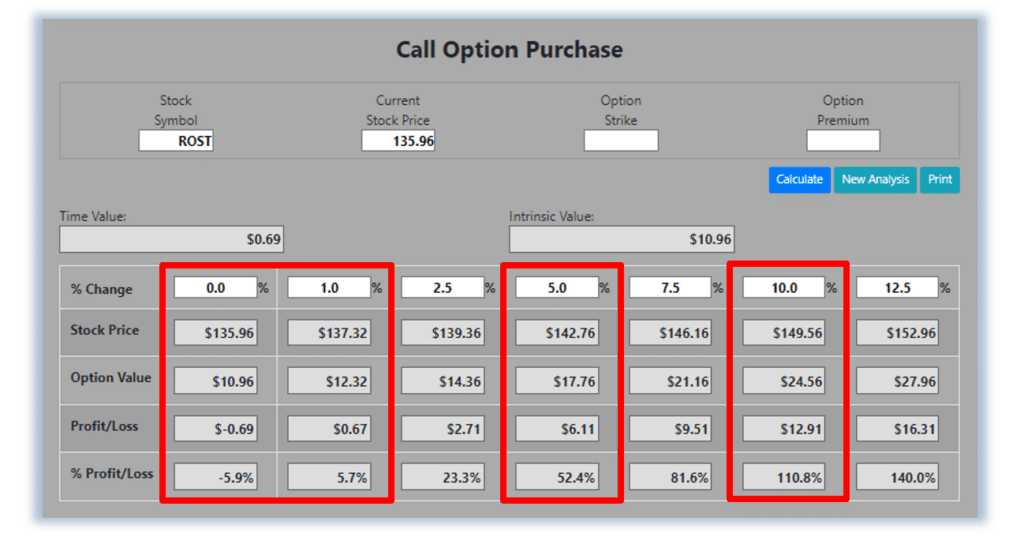

The Call Option Calculator will calculate the profit/loss potential for a call option trade based on the price change of the underlying stock/ETF at option expiration in this example from a flat BK price to a 12.5% increase.

The Optioneering Team uses the 1% Rule to select an option strike price with a higher percentage of winning trades. In the following BK option example, we used the 1% Rule to select the BK option strike price but out of fairness to our paid option service subscribers we don’t list the strike price used in the profit/loss calculation.

Trade with Higher Accuracy

When you use the 1% Rule to select a BK in-the-money option strike price, BK stock only has to increase 1% for the option to breakeven and start profiting! Remember, if you purchase an at-the-money or out-of-the-money call option and the underlying stock closes flat at option expiration it will result in a 100% loss for your option trade! In this example, if BK stock is flat at 52.85 at option expiration, it will only result in a 5.3% loss for the BK option compared to a 100% loss for an at-the-money or out-of-the-money call option.

Using the 1% Rule to select an option strike price can result in a higher percentage of winning trades compared to at-the-money or out-of-the-money call options. This higher accuracy can give you the discipline needed to become a successful option trader and can help avoid 100% losses when trading options.

The goal of this example is to demonstrate the powerful profit potential available from trading options compared to stocks.

The prices and returns represented below were calculated based on the current stock and option pricing for BK on 1/9/2024 before commissions.

When you purchase a call option, there is no limit on the profit potential of the call if the underlying stock continues to move up in price.

For this specific call option, the calculator analysis below reveals if BK stock increases 5.0% at option expiration to 55.49 (circled), the call option would make 41.8% before commission.

If BK stock increases 10.0% at option expiration to 58.14 (circled), the call option would make 88.2% before commission and outperform the stock return nearly 9 to 1*.

The leverage provided by call options allows you to maximize potential returns on bullish stocks.

The Hughes Optioneering Team is here to help you identify profit opportunities just like this one.

Interested in accessing the Optioneering Calculators? Join one of Chuck’s Trading Services for unlimited access! The Optioneering Team has option calculators for six different option strategies that allow you to calculate the profit potential for an option trade before you take the trade.