CB’S SURGE: INSURANCE STOCKS TRIUMPH

POSTED BY CHUCK HUGHES | FEB 6, 2024 | CHUCK’S TRADE OF THE DAY

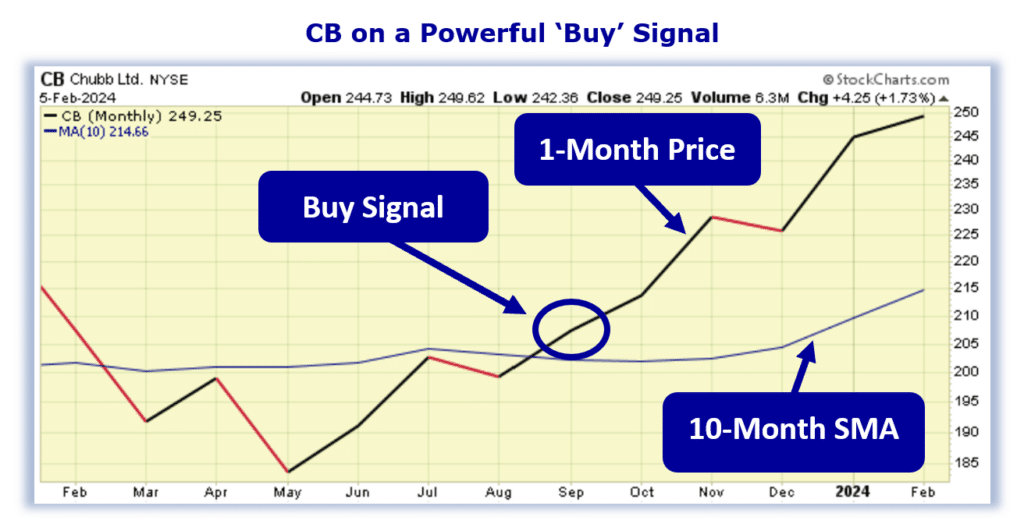

Did you spot this potential trade? If I hadn’t dialed in my options tools, I may have missed it as well. You may recognize the company we are looking at today, Chubb Ltd. (CB). But even if you don’t, what you really need is the chart.

When I was a pilot I couldn’t fly by just looking out the window. I had to use my gauges and instruments. Stock charts are similar to those gauges and make it possible to be more accurate in spotting great set ups.

On this chart we are going to look at the 10-Month Simple Moving Average. If you want more info on this indicator, click here.

As the chart shows, in September, the CB 1-Month Price, crossed above the 10-Month simple moving average (SMA).

As long as the 1-Month price remains above the 10-Month SMA, the stock is more likely to keep trading at new highs and should be purchased.

The good news is CMG is still above the 10-Month SMA so it has solid momentum to the upside and conditions are ripe for a bullish trade. But with just a couple more simple steps we can increase the potential for this trade using options.

HOW TO JUICE UP THE HORSEPOWER USING OPTIONS

Now, since CB’s 1-Month Price is trading above the 10-Month SMA this means the stock’s bullish rally will likely continue. Let’s use the Hughes Optioneering calculator to look at the potential returns for a CB call option purchase.

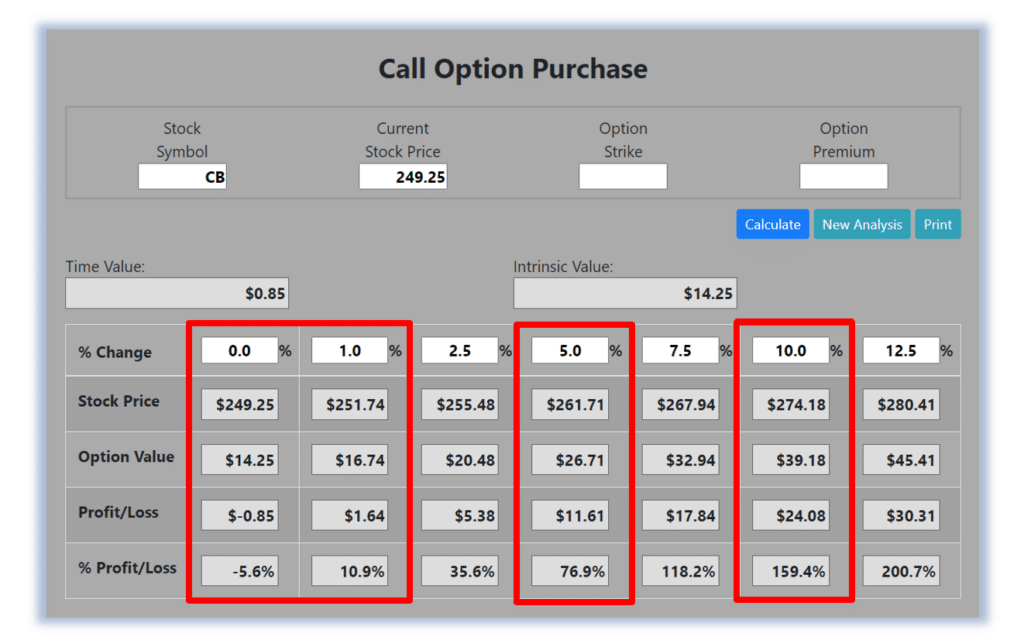

Take a look at the calculator below.

For this specific call option, the calculator analysis below reveals if CB stock increases 5.0% at option expiration to 261.71 (circled), the call option would make 76.9% before commission.

If CB stock increases 10.0% at option expiration to 274.18 (circled), the call option would make 159.4% before commission and outperform the stock return nearly 16 to 1*.

The leverage provided by call options allows you to maximize potential returns on bullish stocks.

*Trading incurs risk and some people lose money trading.